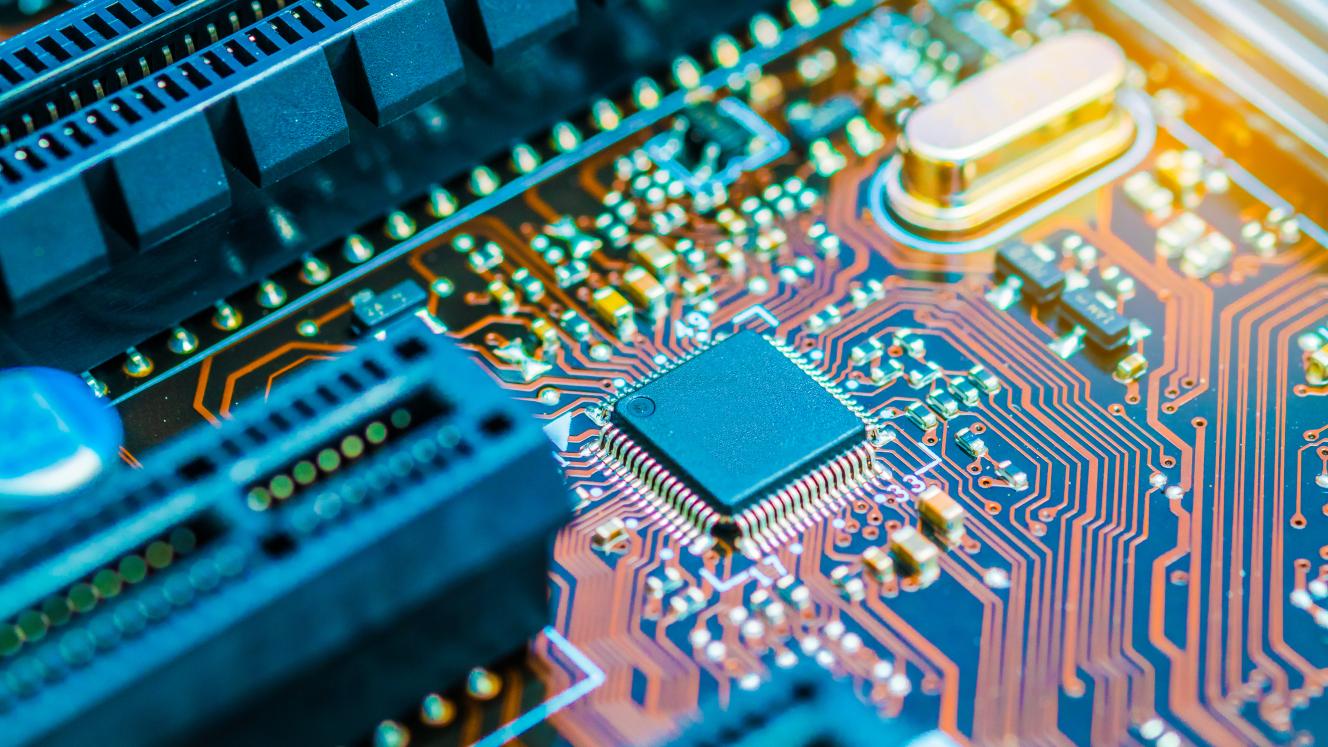

Global semiconductor revenue is projected to total $676 billion in 2022, an increase of 13.6% from 2021, according to Gartner.

“The semi-conductor average selling price (ASP) hike from the chip shortage continues to be a key driver for growth in the global semi-conductor market in 2022, but overall semi-conductor component supply constraints are expected to gradually ease through 2022 and prices will stabilise with the improving inventory situation,” said Alan Priestley, research vice president at Gartner.

Overall, the outlook for global semi-conductor revenue has been increased from the previous quarter’s forecast by $37 billion, to $676 billion (see Table 1). Automotive applications will continue to experience component supply constraints - particularly in micro-controllers (MCUs), power management integrated circuits (PMICs) and voltage regulators — extending into 2023. Slowing growth in PCs, smartphones and server end markets is expected to gradually slow down the growth of semi-conductor revenue as semi-conductor supply and demand gradually comes into balance during 2022.

Table 1. Semi-conductor revenue forecast, worldwide, 2021-2023 (billions of US dollars)

|

2021 |

2022 |

2023 |

|

|

Revenue ($B) |

595.0 |

676.0 |

700.5 |

|

Growth (%) |

26.3 |

13.6 |

3.6 |

Source: Gartner (April 2022)

Chip shortage concerns continue in some sectors

The chip shortage will continue to be a concern for the supply chain of electronics equipment in 2022 and will have different effects in major electronic equipment markets depending on different semi-conductor device types. Most semi-conductor shortages eased in PCs and smartphones as production moved into the off season combined with increased semi-conductor supply into the market. However, some semi-conductor device types will continue to be in short supply in the automotive supply chain through late 2022.

“Although unit production of automotive vehicles will grow below expectation at 12.5% in 2022, semi-conductor device ASPs are expected to remain high due to continued tight supply driving the automotive semi-conductor market to double-digit growth (19%) in 2022,” said Priestley. “Automotive HPC, EV/HEV and advanced driver assistance systems will lead the growth in automotive electronics sectors through the forecast period.”

Memory market to lead semi-conductor revenue growth in 2022

The memory market will remain the largest semi-conductor device market through the forecast period and is projected to account for 31.4% of the overall semi-conductor market in 2022. DRAM and NAND are expected to be in undersupply in the second quarter of 2022. The NAND market will enter oversupply in the fourth quarter of 2022, while DRAM is expected to move into oversupply in the second half of 2023. The combination of megabyte shipments and higher annual average ASPs this year will sustain revenue growth for both markets in 2022, with projected growth of 22.8% for DRAM and 38.1% growth for NAND.

Migration to 5G expected to spur growth

Semi-conductor revenue for smartphones is forecast to increase by 15.2% in 2022, as 5G smartphone unit production is expected to grow by 45.3% in 2022, reaching 808 million units and representing 55% of all smartphones produced.

Aggressive migration from 4G to 5G from major smartphone chipset vendors has temporarily led to a shortage in 4G system-on-chip integrated baseband ICs which began in the second half of 2021. Rising 5G-integrated baseband IC inventory will result in declining prices for 5G smartphones and accelerate the penetration of 5G further through the forecast period.